Making a monthly budget of all the household expenses is an extremely important step to be taken especially when you are trying to make both ends meet. Some people also need to make a budget when they want to be more cautious of their spending habits and want to save some money.

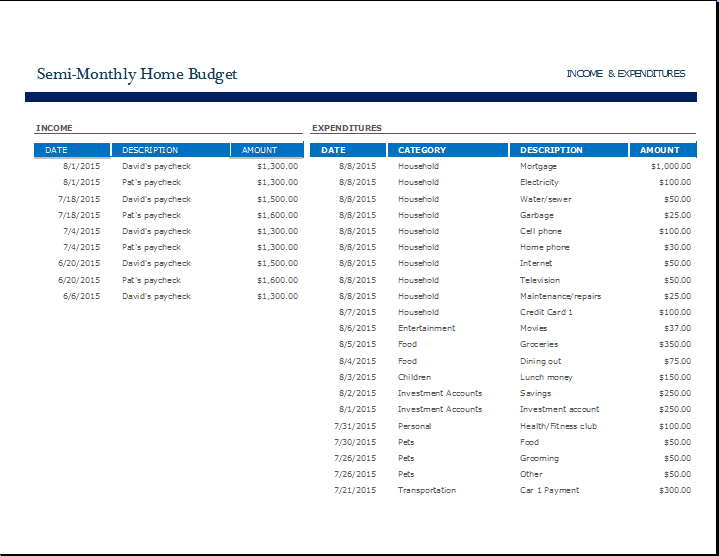

Some people cannot manage a single home budget because it becomes complicated often. So, they make multiple budgets by dividing the total budget of the household expenses into semi-budgets. It is a great technique, especially for homemakers who often have to micromanage everything and feel stressed out when they are unable to do it effectively because of having so much on their minds.

What is a semi-monthly home budget sheet?

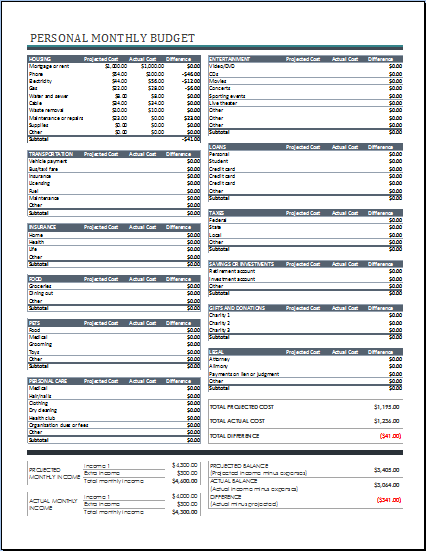

It is a partial monthly home budget that represents the budget of the house for a short period of time in a month. This sheet acts as a tremendous tool as it helps you keep note of the savings, expenses, and the inflow of cash.

So, you can have an overview of the financial situation that you are going through. You can also see how much money you will need for the rest of the month and whether you need to control your expenses so that you don’t face any problems.

How does a semi-budget sheet help the user?

This budget sheet is useful for people who want to keep an efficient track of their income. Some people have multiple sources of income such as those who work as a freelancer that does not have fixed income and keep receiving money as and when they complete a project. So, such a type of income is usually hard to manage and adjust in the budget sheet as many people make a budget at the beginning of the month. However, handling income that is not fixed becomes easy with the help of the semi-budget sheet.

How to use a partial budget sheet?

To get the best out of everything, you need to learn how to use it. Here are a few ways you can make this budget sheet a beneficial instrument for you capable of fulfilling all your budgeting needs:

Divide expenses into categories:

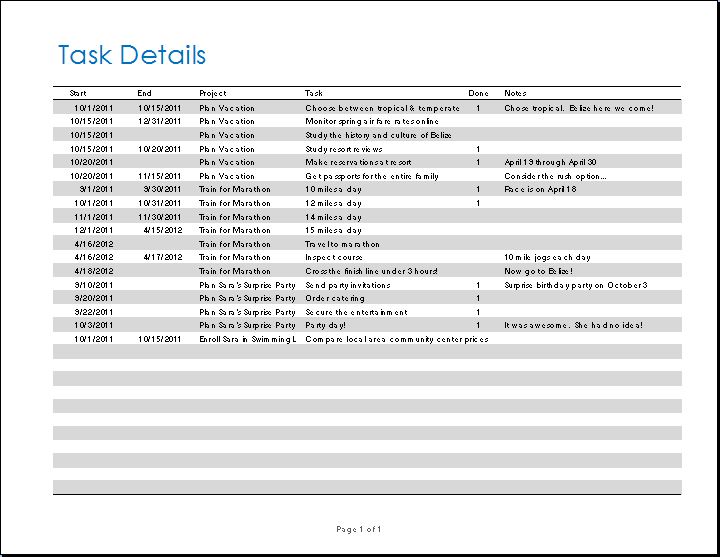

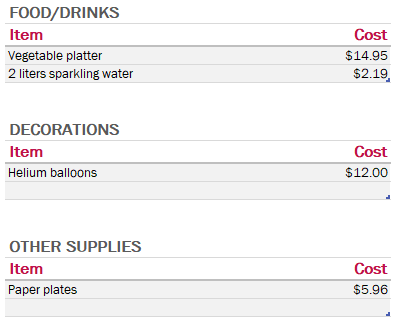

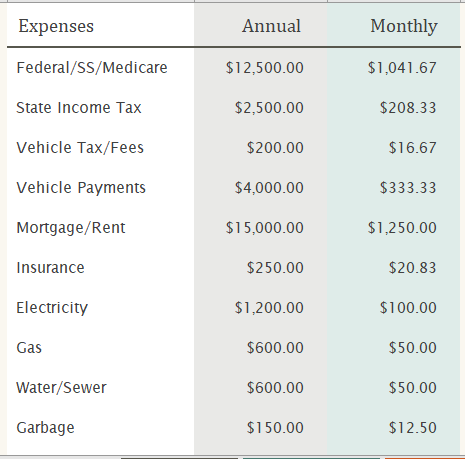

Household expenses daily are numerous. You need to keep track of all of them for an efficient budget. For this purpose, you are recommended to divide your expenses into various categories such as food, entertainment, utility bills, medical expenses, and much more.

You will not have to make a separate entry for everything you spend money on. This way, you will be able to save your time.

Must keep a goal in your mind:

Those who make a complete budget or a partial budget always have a purpose in their mind. Some people make a budget because they want to save money at the end of the month while some make a budget just because they want to live within their means, which is often very difficult when they don’t plan anything ahead of time. So, when you have a goal, you will automatically be accelerated towards it.

Manage your debts:

It is a misconception that budgeting is all about expenses. It also includes some of your goals to get rid of the debts. For this purpose, you can make a separate section in the budget sheet that will keep track of the money that you need to pay as interest and how much you have to pay back. When you manage your debts, you feel mentally and financially better. Therefore, use this semi-budgeting tool for this purpose also.

View your expenses from different aspects:

To better understand your financial health, you should have strong analytical skills. Viewing your overall situation through graphical representations such as pie charts can support you in seeing how much you are spending and where. This will also have a very strong impact on the mind and decision of the user.

Decide how often you want to use it:

A semi-budget sheet can be used multiple times in a month and it depends on you how often you want to use it. You can make one budget sheet a week or more. It is recommended to choose how many sheets will be enough for you in a single month.

- Security Deposit Forms

- Used Bike Sale Receipt

- Coffee Shop Daily Sales Report Template

- Photography Business Quotation

- Computer Repairing Bill Format

- Stationery Bill Format & Template

- Baby Shower Guest Food & Task Planner

- Business Planning Checklist Template

- Event Financial Planner

- Breakeven Analysis Worksheet for Small Business

- Credit Card Use Personal Log

- Equity Reconciliation Report Worksheet