A credit memo invoice is a professionally used formal document that informs the buyer that the seller has applied for some credit on the account of the buyer. Sellers choose to issue the memo invoice when he intends to correct an error that was made in the invoice issued to the buyer previously. Through this note, the buyer comes to know that the seller has made adjustments to his account.

What is the objective behind using a credit memo invoice?

Whenever a memo invoice is sent to the buyer, the buyer perceives that there will be a reduction in the amount that the buyer owes. The seller reduces the amount to be paid by the buyer in many situations. For example, when the buyer returns a product, cancels an order, or requests for the correction of the error seen in the account.

What are the benefits of the credit memo invoice?

For a seller, this document brings plenty of benefits. A few of them are discussed below:

It helps the seller maintains his credibility:

Issuing the invoice again shows that the seller is a professional person who acts responsibly. With this act, customers start to trust him much more. For instance, if there is an error in the amount mentioned on the invoice and the seller acts responsibly to correct it, he is regarded as a credible and trustworthy person.

It strengthens the relationship between the seller and buyer:

Credit notes are generally sent by sellers to their customers to address an issue. If a seller manages to send these payment documents in time, the prompt response to the problem faced by the customer puts a positive impression on the buyer and consequently, the seller can build a strong and positive relationship with his buyers. This is the reason, sellers are always advised to be quick in terms of writing responses or acting in response to a complaint they receive

It documents the adjustments:

There can be a dispute between two parties regarding the adjustment of funds. To prevent these disputes, every professional person has a discussion with their buyers and when there are some agreed-upon adjustments to the account of the buyer, the invoice is corrected and reissued. So, the credit note is a great and very easy way to document a transaction that is being carried out between the businessman and his customers.

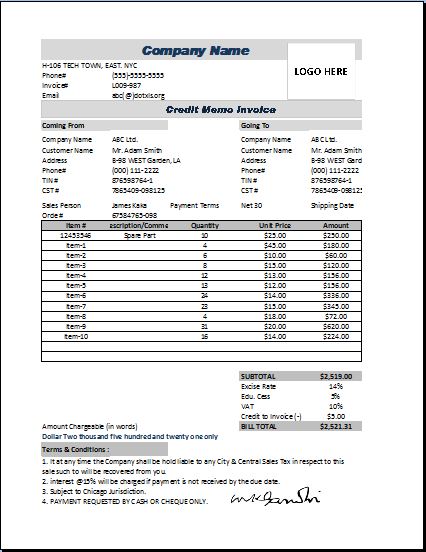

What are the main elements of the credit note?

A credit memo is an important business document that should be designed with care. If you are making a credit note, you should know what it should consist of because it documents every important detail. Here are some very basic and vital components that you must include in the credit note:

Information of the seller and buyer:

Just like a regular sale invoice, this one should also mention the details of the seller and buyer so that it can be seen to whom it belongs. The name of both parties, contact details, name of the company, logo, and some other details are critical to be mentioned in this invoice.

A unique ID number:

Every invoice has a unique number that is used for its identification when its details are entered into the database. It is very easy to retrieve a credit memo with the help of its id number since it is unique.

Date:

The seller should never forget to mention the date on which the order is being placed. This is very important for recordkeeping purposes.

Reason for issuing a credit note:

When the seller reissues an invoice, there should be a section in it where the seller can also provide the reason. If the seller has resolved an issue, that issue and its resolution should be discussed in this section. However, it is important to remain brief because an invoice is a very short document but consists of some crucial details.

A reference to the original invoice:

Another section of the note should refer to the original invoice so that the customer can see in which invoice he has made the changes. This usually mentions the unique id of that original invoice.

- Security Deposit Forms

- Used Bike Sale Receipt

- Coffee Shop Daily Sales Report Template

- Photography Business Quotation

- Computer Repairing Bill Format

- Stationery Bill Format & Template

- Baby Shower Guest Food & Task Planner

- Business Planning Checklist Template

- Event Financial Planner

- Breakeven Analysis Worksheet for Small Business

- Credit Card Use Personal Log

- Equity Reconciliation Report Worksheet

- Customer Ranking Tool Worksheet

- Family Event Calendar Template for Excel

- Cash Flow Report Worksheet