Keeping a track of what a business is earning after all its expenses have been paid out is an essential element to know, as a business can only survive if it is profitable at least in the long run. To calculate and track the profitability of a small organization a profit and loss statement worksheet for a small business is used.

A profit loss statement worksheet is a worksheet that lists the figures of income, expenses, and net profit or loss of a small business. It is made to analyze the profitability of a small-scale business, so as to know if it is a beneficial business, or is going toward bankruptcy.

In addition, the profitability levels of different time periods are compared to examine a business’s success trend. As it is for a small business, it is a simple sheet as compared to the profit and loss statements of a big firm, due to the less complicated income sources and expenses.

The profit and loss statement worksheet is helpful in many ways…

There are many advantages of maintaining this sheet, such as:

- Indicates the performance of the business.

Along with other financial statements, this statement is a strong tool for analyzing the performance of a business over a certain period as well as the prevalent issues, which need to be addressed.

- A breakdown or segregation of income and expenses can clearly be seen.

As this statement lists every expense and income source separately, it helps in analyzing and managing the accounts, and the overall business practices. For instance, if the rent expense is too high, and the business has the funds to purchase a small space for its operations, through this statement, the business might decide to opt for the second option.

- The net values would indicate if a business was earning more or spending more.

If a business has low total income and high expenses, it will show a negative figure, i.e., a loss. If this continues, the business will know, that it is spending more money on expenses than it is generating from different sources.

- Helps in the assessment of the risk of bankruptcy.

If the business is continuously getting losses, or very low profitability is being experienced, it would indicate the chances of bankruptcy, and the business can take the relevant measures in time.

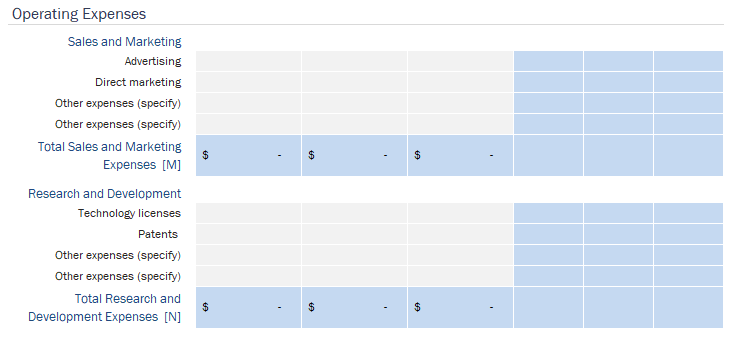

Miscellaneous parts of the worksheet

The fields or details in this worksheet may vary as per the type of business, e.g., different business types have different income sources and expenses. However, the main heads in this type of worksheet are:

- Income from various sources.

- Total income.

- Cost of goods sold [(opening stock +purchases) – closing stock].

- Gross profit.

- Fixed expenses.

- Variable expenses.

- Total expenses.

- Taxes.

- Income before taxes.

- Net income or net profit/loss after taxes.

Preview

More Templates…

- Security Deposit Forms

- Used Bike Sale Receipt

- Coffee Shop Daily Sales Report Template

- Photography Business Quotation

- Computer Repairing Bill Format

- Stationery Bill Format & Template

- Baby Shower Guest Food & Task Planner

- Business Planning Checklist Template

- Event Financial Planner

- Breakeven Analysis Worksheet for Small Business

- Credit Card Use Personal Log

- Equity Reconciliation Report Worksheet

- Customer Ranking Tool Worksheet

- Family Event Calendar Template for Excel

- Cash Flow Report Worksheet