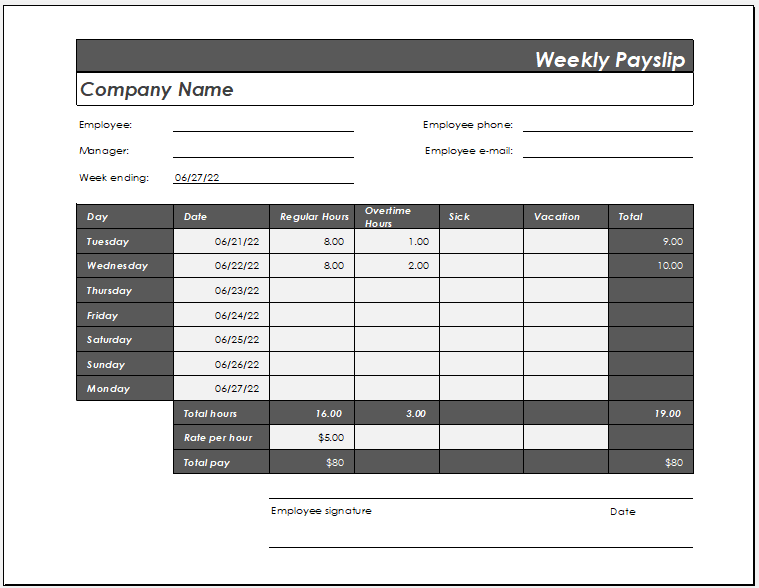

One Week Payslip Template

We work to earn allowing us to live comfortably. Pay is an important part of any organization. Without this, no one will want to work or be working. The way employees must be paid is perfect so that no one gets left out and no error occurs. Records need to be kept of pay in case any issue occurs.

One-week pay slips are those given to employees stating when they got paid, telling the total amount of pay, along with the tax plus insurance being deducted. The pay slip includes all information about an employee along with their pay. It is the payment paid for a single week. The pay slip is required by all organizations. The pay slip gets printed and then given to staff members in hard copy form. It can be sent via email as well.

A one-week pay slip is important when staff is being paid for some work done weekly. It can be kept as a record by the institution, company, etc., and by the staff as well. Records are required as any problem can occur later on when a staff member claims they were not paid for some work. The pay slip is taken out to confirm the claim. If any case occurs against the organization, the records can be used. It is important to have complete records of pay being paid to all employees.

A one-week pay slip is a formal and professional document. It should be created by keeping these points in mind. The following tips can be considered when creating the payslip:

Application: Selecting the best application to make the pay slip is important if you want it to be easy to fill in and read. Pay slips are often made in Microsoft Excel and Microsoft Word. You can save time by creating a template for these applications.

Heading: A heading is an important part. The one for this will be “One Week Pay slip”. The heading allows all to know what the document is about.

Date: The date the pay slip was generated should be included.

Week details: The pay slip is a weekly one. Tell what week it is for clearly. An area must be present for this.

Company details: It is necessary to state the company details like its name and logo on the document. Add the address, and contact details like phone number, email, etc. This gives it a professional look.

Employee details: Include the details of the employee. It will be their job title, and status. The information must make it known who the employee is. The contact details of the employee should be given also.

Balance details: This is an important part of the pay slip. The balance details have to be stated clearly. Include the total amount of days that the employee worked. It is a weekly one so includes it for that particular week. The total amount which is being paid to an employee and deductions must be stated on the pay slip. Some employees work per hour, state the number of hours that they worked.

Table: The table should state the day, date, regular hours, overtime hours, sick, vacation, and total. All these details need to be included so that the right total can be gotten. At the bottom of the table will be the total hours for all stated columns. The rate per hour must be given. Also, state the total pay.

Signatures: The signature of the employee and manager must be present along with the date that the document gets signed. When people sign the pay slip then it confirms that these individuals believe the information to be true to their knowledge.

The weekly pay slip is for those businesses that pay employees weekly. The pay slip can be used to calculate the total amount. You should add all necessary information like extra hours, sick hours, etc. These are needed so that the correct amount can be deduced. Make it professionally as it is a formal document. The above points can be kept in mind when doing this. Remember that it will probably be kept as a record so it must be clear to read and filled in truthfully.

[.xls file format]

← Previous Article

Food Bill Format with GSTNext Article →

Bill Paying Checklist Template