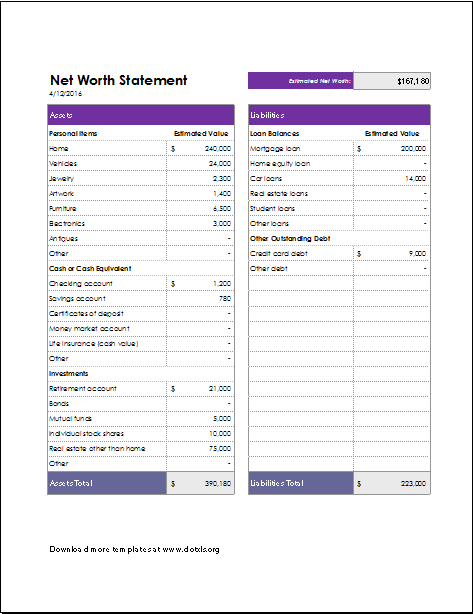

A net worth statement refers to the tool which is used to assess the financial position of either an individual or company or business at a specific point in time. It provides a detailed picture of the overall health of a company from financial aspects. A net worth statement is considered important while making a sale in any such task.

A net worth statement sheet provides lists of all assets and liabilities connected to the individual or company in question. It gives all the details of what an individual owns (asset) and what he owes to someone (debt) so that the net worth can be calculated accurately.

The formula for calculating net worth is mentioned below,

Net worth = Assets – Liabilities

Contents of the statement

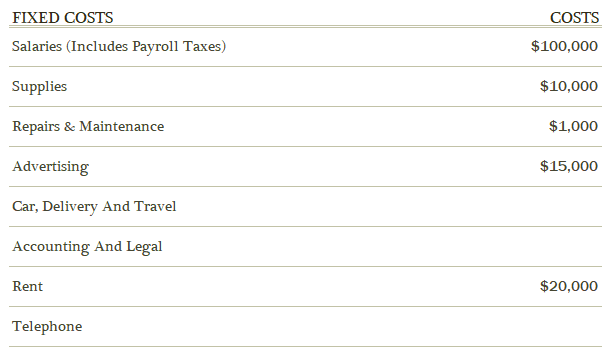

Contents of net worth statement sheet vary depending on the business of a company because more business means more assets and liabilities. Some of the general contents of a net worth statement sheet are given below,

- Assets constitute one section of the statement sheet and refer to all the valued materialistic things owned by the company. These things may include property, jewelry, vehicles, cash, investments, residential property, companies, or any other businesses. Assets generally refer to the possessions of a company which has value and can be exchanged for cash. Assets are ranked in terms of liquidity which means the fastest an asset can be converted to cash.

- Liabilities refer to the debt, the company has to pay within a due period. It may include mortgages, investment loans, credit card bills, or any other type of debt. Liabilities are ranked in terms of maturity i.e., the nearest that it has to pay off. Small loans need to be paid off within a short period of time as compared to mortgages that are spanned over years of installments.

A positive net worth reflects that company is financially healthy for a business whereas a negative net worth indicates that the company is under financial stress because liabilities are more than assets which creates duress on the company’s finances. It also explains how a company needs to mend its strategies for acquiring more business and turning net worth into positive.

How significant is a net worth statement?

The significance of a net worth statement can be evaluated as,

- It creates a detailed picture of a company’s net worth thus, helping anyone to assess the financial situation of a company in great depth.

- Listing all the liabilities makes it easier to be aware of all the debts that a company owed and should be paid within due time.

- Negative net worth is an indication of changed strategies to draw more business toward the company.

- Positive net worth reflects that company is financially stable and can invest in more profitable ventures.

- A net worth statement can be kept as proof of all the assets and debts that are to be paid off by the company.

- It can be used to track the progress of the company over a certain period.

- The statement worksheet indicates the prime time for investing in other businesses and provides information when the tables are turned.

Template

File Size 45 KB