Businesses aim to achieve high levels of effectiveness and efficiency, which is possible through the maximum utilization of their resources. If an organization can forecast its expenses and income sources well it can put its resources to proper use. For that business monthly budget sheet is made to track a record of the monthly expenses and income levels.

What is a business monthly budget sheet?

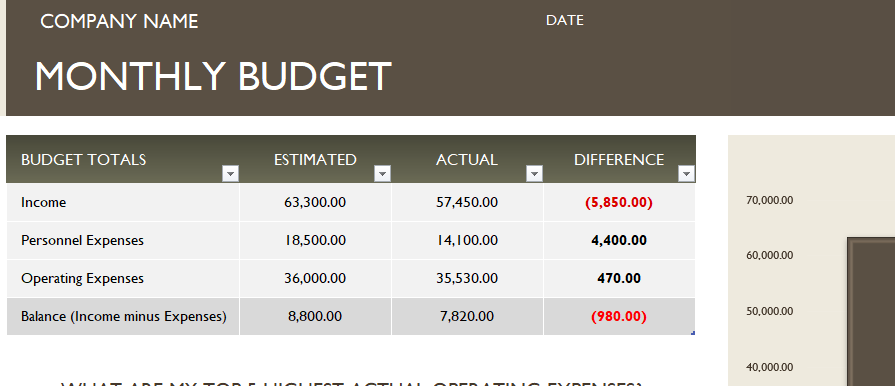

A business monthly budget sheet is a spreadsheet template in which an organization inserts its predicted expenses and income that are based on the old figures and new work projects. In addition, a column also records the actual incurred expenses and income so that a difference between the budgeted and actual figures can be calculated. This budget sheet is prepared monthly. It is like an income statement, with the difference that it is made every month, and record both budgeted and actual figures.

What are the benefits of a business monthly budget sheet?

A business monthly budget sheet has many associated advantages, which is why it is often opted for by the companies. Some of those are:

- Improved planning and effective allocation of resources

The business monthly budget sheet allows for better allocation of the available resources. For instance, if the income levels are high, the money can be planned to put in for better use, such as in additional investments, purchasing extra inventory, etc.

- Identification of any probable issue

As it is a budgeted sheet, if the income levels are predicted to be low or expenses are high the organization can work toward improving the scenario even before it actually happens. Many companies are even able to save themselves from probable bankruptcies by planning and budgeting properly.

- Highlight discrepancies

If there are huge differences between the budgeted and actual figures, it indicates to the management, that an investigation needs to be done to minimize the discrepancies.

- Setting and Fulfillment of goals and objectives

Having budgeted figures, the management can set goals for the workers, and the employee assessment can be conducted based on the achievement of such goals.

- Track performance

The monthly budget sheets help in evaluating the company’s performance. If the company has been able to achieve the budgeted goals in actual terms, it indicates good performance levels and vice versa.

- Satisfaction of stakeholders

When a stakeholder questions about the profit levels or the performance levels the monthly budget sheets with low discrepancies can be presented to satisfy them.

What are the main components of a business monthly budget sheet?

The details presented in this sheet may vary as per the requirements of the organization, expense categories, income sources, and the choice of the template. However, generally, the following information is included in such spreadsheets:

- Expenses – budgeted and actual.

- Income – budgeted and actual.

- Discrepancies – difference between the budgeted and actual figures.

- Total – the total income and total expenses.

- Net income/loss – difference between the total expenses and total income.