When an individual or an organization is seeking a loan there may be many options available that need to be analyzed and assessed based on several factors. The best option is then opted for. The variables that help in deciding the best option may vary from one person’s priorities to another’s. This evaluation becomes easy if one uses a loan comparison calculator.

What is a loan comparison calculator?

A loan comparison calculator works as a loan payment calculator. It is a tool to compare and assess repayments of various loan options. The required details are inserted, and the calculator calculates and gives the results of the monthly payments, total interest, total payment, dispersal of payments, total loan period, etc. This tool is often used to clarify the situation for the borrower to know which loan option suits him well. Different calculators can compare a different number of loans at one time.

What are the advantages of a loan comparison calculator?

People frequently use this calculator due to the numerous benefits, that are linked to it. Some of them are listed here:

- The comparison is based on facts and figures.

As the loan calculator presents all the cost figures, which are factual and not hypothetical, the comparison of loan options becomes effective, valid, and accurate.

- All the relevant costs are presented in one place.

As all the figures are brought together through this calculator, it helps in making the analysis and evaluation easier.

- Improved loan option selection.

One may not be able to select the best option from the available ones if the comparison is not properly made. As this calculator puts all the information and calculations in a clear perspective and lets the borrower compare them, he can choose the loan that suits him well in terms of costs, payments, interest rate, time period, etc. For instance, if loan A has a lower interest rate than loan B, one may get attracted to it, but using this calculator may reveal the higher costs associated with loan A, and hence, a better choice can be made.

- The selection can be based on the person’s priorities.

A person’s priority of loan features may vary as well. For instance, one person may be ready to pay a higher interest rate but want a longer-term loan and vice versa. Through this calculator, one can know, the features of which loan fulfill his priorities.

What are the main components of a loan comparison calculator?

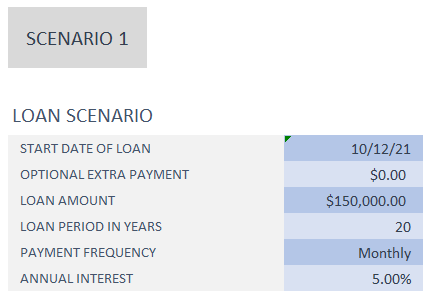

The fields and categories of this calculator may vary in the detailing of information as well as the number of loans it is able to compare. However, generally, the following elements are there in this tool:

- Loan amount.

- Interest rate.

- Loan term in years.

- Minimum payment.

- Amortization period and number of payments.

- Monthly payment amount.

- Any additional payments, such as initialization fee, processing fees, etc.

- Total interest.

- Total cumulative payment.

- Annual percentage rate (APR).

Usually, the loan comparison calculator assumes the same interest rate over the total loan period.