Companies lay their foundation on a chain of rules that keeps them on right track and also navigate their future based on their performance. It clearly describes all the situations that the company might face and how they should take preventive measures. These rules not only prevent troubles but also focus on customer dealing, stock renewal, update, and record maintenance. Rules of all companies may be different but facilitating their people is considered a top priority everywhere.

An insurance policy is a contract between two parties who are known as the insurer and the insured. Insured takes policy to cater to the damage caused to personal or professional property or material. Insurance policy can also be taken for a living human being for a definite period. It is beneficial for many aspects of human life and caters to a number of man-made damages.

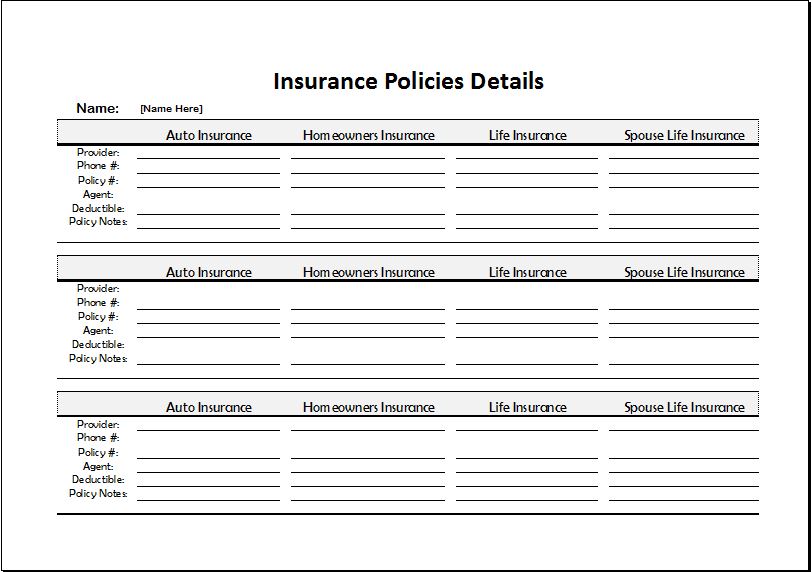

An insurance policy record sheet is a document that keeps the data of all insurance policies in an organized manner. This data may include policy number, type of policy, name of the policyholder, period of the policy, and related information. It facilitates both insurers and the insured in keeping a track of all the data in one place. A record sheet makes it easier to navigate any important change or category within a matter of seconds.

Format of the sheet

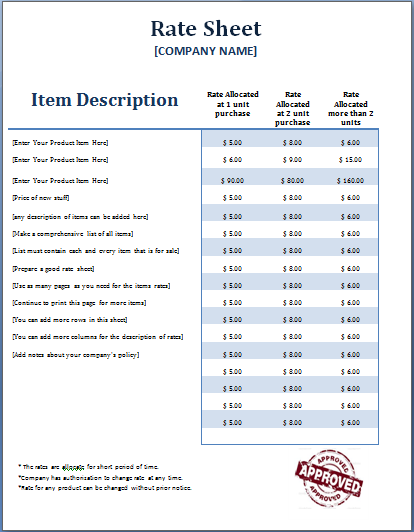

There are various forms of keeping record sheets and it mainly depends on the policyholder to organize data in a manner they like. The major purpose of maintaining a record sheet is to present data according to a system in an orderly fashion.

It can be arranged in a way that all the information related to one policy is added after one heading and similarly all policies are added in tandem. Moreover, it will be helpful to gather more information from one policy or for the dictating policyholder about important information.

It can also be categorized by using columns in a tandem fashion and adding activities as a list. This format makes it easier to navigate every column of every policy thus, making it feasible for the policyholder.

Table and contents of the sheet

Contents of the insurance policy record sheets are not fixed and change with respect to the type of policy. Some major information mentioned on the record sheet includes,

- Name of Policyholder

- Contact information

- Name of the insurance company

- Type of policy (personal, house, auto, business)

- Commencement and expiration date

- Limits of Coverage

The insurance policy record sheet may also include information about,

- Amount of premium

- Date of premium

- Date of paying more installments

Insurance policy record sheets are considered significant because of the following reasons,

- It helps a policyholder to know everything about their policy and clear their doubts.

- It is a valuable tool for tracking and managing insurance coverage.

- It saves policyholders from any financial losses.

- A policy record sheet helps policyholders to claim their loss.

- It provides a clear picture of an individual’s insurance coverage.

- Record sheets are easy to manage and user-friendly tool that keeps the data organized and helps in tracking information quickly.

Preview