In the business world, a proper record is maintained whenever a transaction between two parties is performed. This is extremely important as it keeps everyone informed as to how much money has been paid and when. This way, everyone remains on one page and there are very less chances for disputes to occur.

Invoices are an essential part of the purchasing process because they are a source of communication between the seller and the buyer. Usually, the seller issues the purchase invoice whenever a buyer purchases any product from the seller.

What are purchase invoices?

These invoices are issued at the time of the purchase when the customer has placed an order and now he is waiting for the seller to issue him the invoice so that he can see the total bill and make payment. When the customer has made the payment, the process of purchases is deemed complete successfully.

Usually, whenever a seller needs to request the buyer, he does not do it verbally. If they do it verbally, they look so unprofessional. Customers also don’t like being asked to pay verbally. This is the reason, invoices are used at the time of buying something.

Is a purchase invoice needed for recordkeeping?

It is essential for a business to issue the invoice because as and when they print it out, an update is made in the database of the company showing a product has been sold out and the amount mentioned in the invoice has been paid.

The invoice also mentions the total amount of tax a buyer pays in addition to paying the total price of the product of the store. So, when the seller has to prove that he has been paying the tax, the invoice can play a big role in proving it. Customers who have to exchange or return a product to a store also need an invoice to first prove that they bought the product from that store. If they don’t have an invoice, they will not be able to return the product.

Make a professional invoice

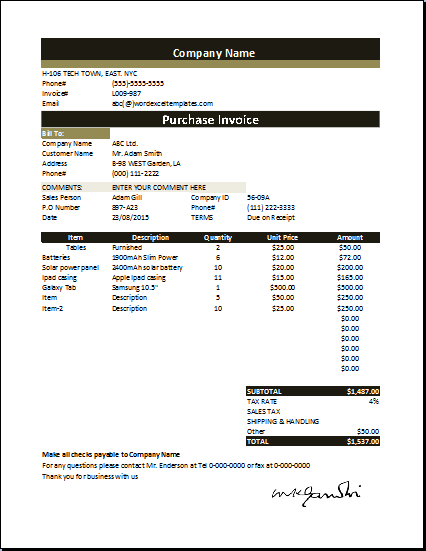

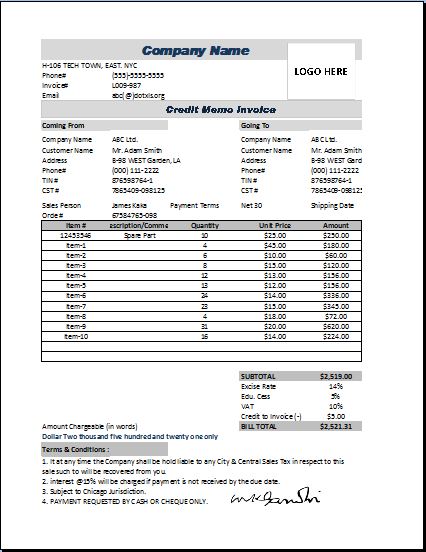

If you want an invoice that looks professional and has a purpose in your business, make sure that you fill it with the following details while creating it:

Name and logo of your business:

The buyer will trust the seller only if the invoice looks real and professional. The name and logo of the business make it look professional and authentic. Therefore, never forget to include them in the header section of the bill of sale.

A unique bill ID:

A business often has to deal with so many bills as there are multiple customers of a business. It is convenient for the system to assign a unique ID to a bill because it makes the retrieval of the bill easier. In addition, there can be many things similar in two bills issued on the same date and to the same person. However, the unique ID always maintains the difference.

Date:

The date on which the bill of sale has been issued is also an important element because businesses keep a record of the sale and purchase based on the day to determine the profit generated on a particular date.

Information of the seller:

The name of the seller, address, contact number, and other details of the seller are mentioned in the invoice.

Information about the payment:

This is the section where the payment required to be paid by the buyer is demonstrated. It usually includes the breakdown of the payment and at the end, the total bill to be paid by the customer is also mentioned. People usually pay attention to this part the most because they want to see how much they have to pay. Once the payment is made, the invoice is stamped or converted into a receipt that a customer can keep with him.

Terms and conditions:

The seller also mentions the terms and conditions of the sale of the product. It should not include terms and conditions of the business and it should remain confined to those conditions that are required to be kept in mind while purchasing a product. Since the invoice is printed on a small piece of paper, this section can be printed on its back.