Employees use expense reports to keep track of their business-related expenses for a specific period, such as months or years. This aids businesses in knowing how much money is being spent and where it is going. Typically, in corporate systems, companies require their employees to submit these reports to keep track of expenditures related to reimbursements or to keep track of costs associated with a firm for tax purposes.

Expense reports aid in increased productivity and low error rates. A business can make its financial management more sound by cutting down on the amount of time staff spend tracking and recording expenses and automating the expense report process. This also limits the possibility of mistakes or anomalies in the expense reports while also saving the firm time and money.

The report validates the following…

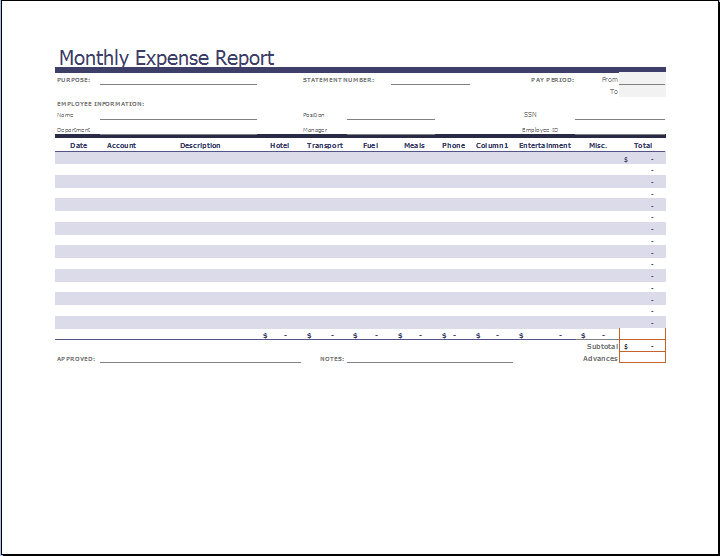

A monthly expense report sheet should validate the following essential points:

- It must contain the necessary information about the employee. This information consists of the person’s name, department, and work title.

- The duration of the expense report must be mentioned.

- A category should be defined for each report so that it is easy to differentiate whether the report contains information on expenses related to travel, meals, or office supplies.

- Each expense should have a date included to rightly keep track of all the expenses.

- A concise summary of the expense, including its purpose and other pertinent information, should be included here.

- Employees must submit a copy of the receipt or other supporting documents for each expense. This can assist in confirming the expense and making sure it was incurred for professional purposes.

- The actual amount of expense should be mentioned, including any applicable taxes or fees, should be included in this amount.

- To specify, whether the payment was made using cash, through a credit card, cheque, or online transfer must be included as a payment method.

- To ensure that the stated information related to expenses is true and was rightly incurred for business purposes, the report should be signed and dated by the employees.

Additional components…

A monthly expense report sheet may also contain the following additional components:

- A breakdown of all expenditures by category.

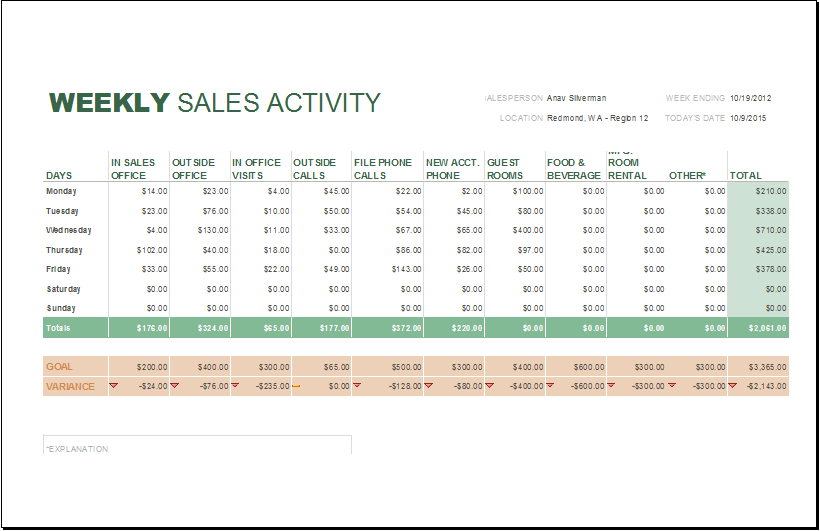

- A day-by-day or week-by-week cost-breakdown information.

- A breakdown of any costs that aren’t covered by insurance.

- Any comments or justifications for expensive or unusual costs?

- A part for inspection or approval by the boss.

An employee’s business-related expenses made during a specific period must be clearly and accurately documented, and this is the main goal of a monthly expense report sheet. For businesses with small budgets or divisions with severe expenditure limitations, this might be very significant.

It highlights the area of overspending…

A business might find areas where it is overspending and make modifications to cut costs by routinely analyzing expense reports. Employees may guarantee they are reimbursed for their business expenses and assist their organizations in managing their budgets and analyzing their spending by meticulously tracking and documenting these costs. Another important element of an expense report sheet is appropriate scrutiny to maintain the credibility of the report.