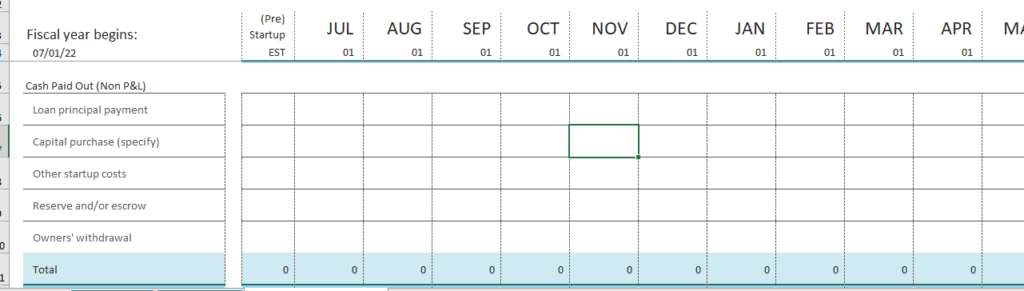

A cash flow report is a document that is used by businesses to keep track of the inflow and outflow of cash. A business uses many cash receipts and disbursements that clearly talk about the outflow and inflow of cash. However, using these things for determining the cash flow is not easy. Therefore, most businesses prefer using the cash flow report for giving the details about the cash flows in and out of the business.

Cash flow report on a daily basis

The cash that flows in and out of business on a daily basis is tracked and kept in the cash flow report. Any business that wants to have a proper paper trail should use the cash flow report.

A business issues a receipt to the customers upon receiving the cash from customers. The receipt is basically an invoice that is used by the business to keep track of the cash it receives at a particular time. The cash flow report is made daily in which the updates are made, and supporting documents are used to keep track of the inflow and outflow of the cash. If there is any unusual cash transaction carried out in a business, you can easily find it out.

How to make a cash flow report

There are a series of steps that can be taken to make an effective cash flow report

- Start making the cash flow report by mentioning the date at the top of the document. Mention the opening balance that you have at the start of the day.

- It is important to mention the cash in the cash flow report that a business has received a day before. The cash paid by the customers through the check is also added to the cash flow report. The credit card total is also added to the cash flow report.

- Some customers pay outstanding invoices. They should also be mentioned in the cash flow report.

- If there are infrequent and quite unusual transactions in a business, it is important to specify them in the cash flow report.

- In the cash flow report, the cash inflow on a particular day will be calculated by subtotaling the cash payments, credit card sales, receivable payments, and whatnot.

- The amount of credit card sales should be subtracted from the cash subtotal.

- For calculating the cash outflow, subtract the amount from the subtotal that you have paid to your customers in the form of refunds. Also, subtract the payroll checks that you have cash for all the employees that are working for you.

- All the bills that you have paid to different vendors should also be specified in the cash outflow section.

The cash a business has in its possession tells a lot about the financial strength of the business. If you want to know how much a business has, you can subtract the cash outflow from the cash inflow.

Excel Template

Excel (.xls) File Size 85 KB

More Excel Templates…

- Security Deposit Forms

- Used Bike Sale Receipt

- Coffee Shop Daily Sales Report Template

- Photography Business Quotation

- Computer Repairing Bill Format

- Stationery Bill Format & Template

- Baby Shower Guest Food & Task Planner

- Business Planning Checklist Template

- Event Financial Planner

- Breakeven Analysis Worksheet for Small Business

- Credit Card Use Personal Log

- Equity Reconciliation Report Worksheet

- Customer Ranking Tool Worksheet

- Family Event Calendar Template for Excel

- Cash Flow Report Worksheet