Paying bills is an important part of life. Everyone has a responsibility to do this. There are electricity, gas, phone, etc. bills. When any is not paid it can cause issues. Therefore, it is necessary to remember to pay all before their due date. When the due date has passed, usually the amount becomes more.

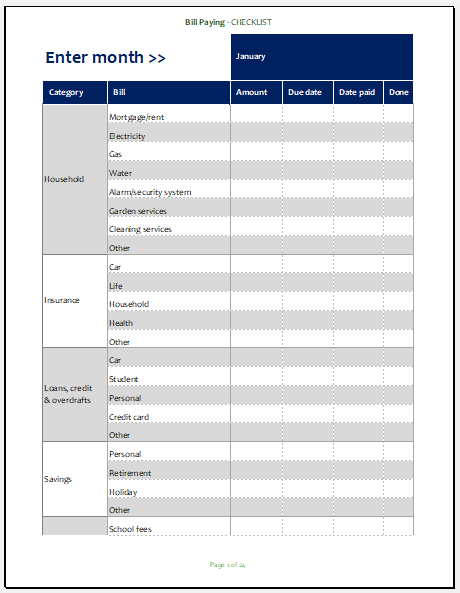

A bill pay checklist gets employed to check off bills when you pay every month. It includes a list of all bills that have to be paid such as a mortgage, health insurance, car loan, internet, natural gas, etc.

A bill pay checklist is a simple way to see any oversights before you get any late fees along with added interest. It helps you know which bills need to be paid and when. If an error occurs whereby the authorities say you have not paid a certain bill, the checklist can be taken out so you can remember if you have paid it. The receipt will be taken out and shown. You will therefore not pay a single bill twice. A company and also a homeowner will find the checklist helpful. You will know the total amount you pay in bills or the total amount paid off a certain bill.

When wanting to make a bill pay checklist include all bills that must be paid so that you do not forget any. The following tips can be kept in mind:

Application: Choose an application to make the bill pay checklist. Microsoft Word or Microsoft Excel can be used for this purpose. It is better to create a template in these applications which can be printed out rather than writing it. Select a readable and good font. If you are making it for your office the font must be a professional one.

Heading: The checklist has to have a heading. When it has a heading, you will know what it is for. The heading will be “Bill Pay Checklist”. The heading will be a bigger size.

Table: Make a table to fill in as it is easier to read and fill as well. You will be able to simply browse it whenever required. Tables make work easier.

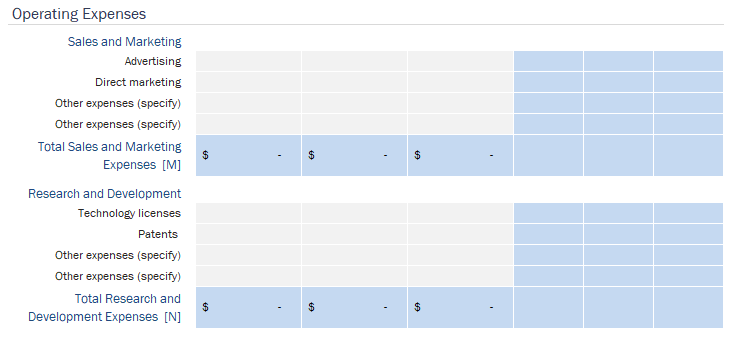

Bills: A column for monthly bills states all bills separately which have to be paid on a monthly basis. It will include things like internet, electricity, insurance, etc. You can have a separate one for quarterly bills, annual bills, etc. For instance, you may need to pay a water bill annually.

Due: This column is very important. You will know by when you are expected to pay the bill. The due date will be stated here.

Amount: The total amount you need to pay for every bill has to be given here. Only give the amount.

Auto-pay: If you have hired a creditor letting them take out money from your credit card, savings, etc. to pay your bills, you can have this column. It will let you know when any bill has been auto-paid.

Months: A separate column for every month of the year has to be included. You will tick in this column according to the bill that has been paid for that month.

Precise: The table must not be filled in by adding many descriptions and details. Allow it to be simple where you just tick in whether it has been paid or not. In this way, it will be easier to consult and read. Make it in such a way so that it is easy to fill in by everyone.

A bill pay checklist is a necessary document that helps you know which bills you have paid, and which still need paying. It aids you in making sure that no bill is left unpaid. Rather than having to pay late fees spend time making the table. Some services may close their service after a certain day of the bill not being paid. For instance, your internet provider may do this. This causes tension especially if you need work done. Therefore, it is better to be organized and have a bill pay checklist.